The U.S. Division of Justice (DOJ) has seized over $8.2 million price of USDT (Tether) cryptocurrency that was stolen through ‘romance baiting’ scams.

Beforehand referred to as ‘pig butchering,’ in this kind of monetary fraud victims are manipulated into making investments on fraudulent web sites/apps that showcase huge returns.

Satisfied they’re making a revenue, the victims make investments growing quantities, however once they try and make any vital withdrawals, they hit varied issues that forestall them from finishing the motion.

In the end, they notice they invested in a faux platform and all their cash went straight into the risk actors’ pockets.

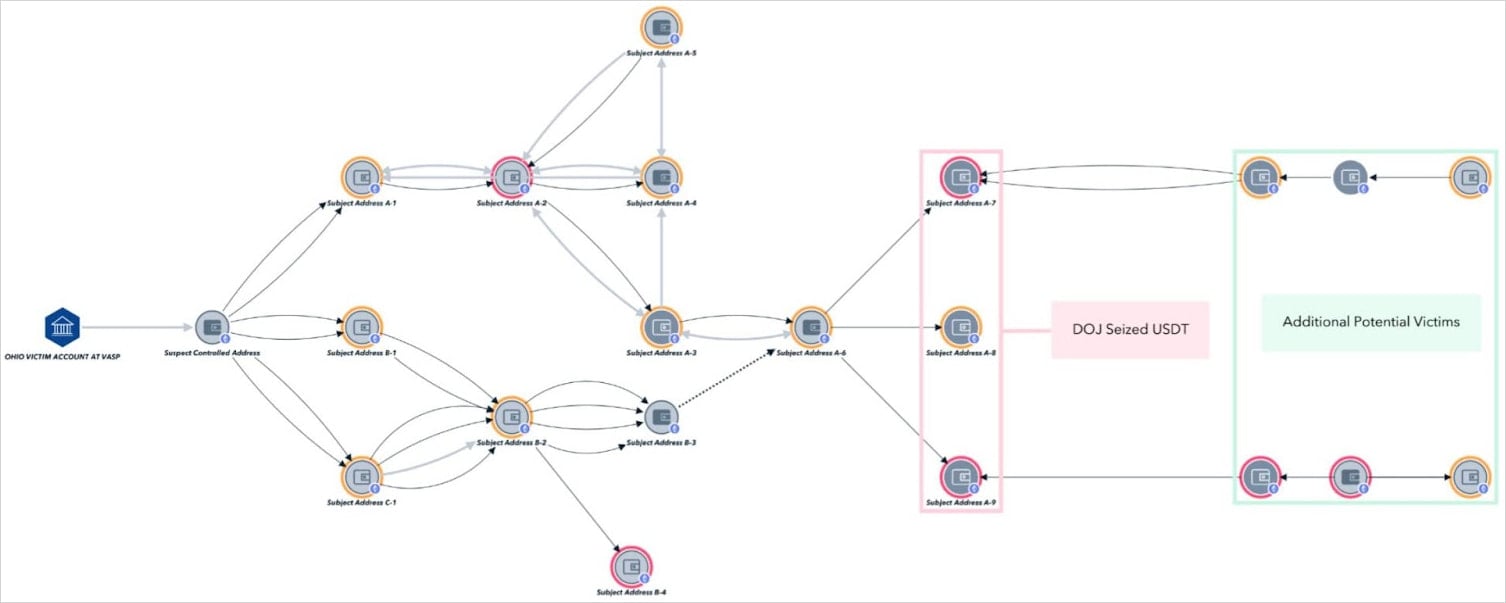

Blockchain intelligence platform TRM Labs reviews that U.S. state investigators, primarily the FBI, uncovered laundering patterns of quantities linked to ‘romance baiting’ operators, enabling them to file a twin authorized forfeiture:

- Wire fraud (18 U.S.C. 981(a)(1)(C)) for straight traceable funds.

- Cash laundering (18 U.S.C. § 981(a)(1)(A)) for commingled or untraceable funds.

This allowed the complete seizure of the belongings. As defined in the criticism, Tether Restricted froze the funds in June 2024, burned the unique USDT tokens, and reissued them into legislation enforcement-controlled wallets in November 2024.

The seizure opens the pathway for restitution to identified victims, in addition to others whom the FBI is trying to find by backward tracing the seized wallets.

Supply: TRM Labs

The criticism names 5 victims from Ohio, Michigan, California, Utah, and North Carolina, who collectively misplaced over $1.6 million. A complete of 38 victimized cryptocurrency accounts with losses exceeding $5.2 million had been confirmed.

The risk group behind the actual ‘romance baiting’ operation is believed to be tied to human trafficking syndicates in Cambodia and Myanmar.

The rip-off operation relied on typical ways similar to permitting preliminary small revenue withdrawals to construct belief, claiming “taxation” and “credit score rating” charges as pretexts for requesting more cash, after which resorting to threats and intimidation as soon as victims ran out of cash.

The worst-case particular person loss described within the criticism was that of a sufferer from Mentor, Ohio, who misplaced roughly $663,352 in complete ($250,000 in preliminary funding, $174,400 in “launch charges,” $238,946 in “dealing with charges”).

The risk actors demanded one other $300,000 to “enhance her credit score rating,” however after having already liquidated her total Roth IRA and life financial savings, she could not pay that quantity. In response, the scammer threatened to hurt her family and friends.

‘Romance baiting’ scams may be devastating for victims, so on the lookout for pink flags and taking your time to verify funding platform legitimacy is essential.

By no means belief “assured returns” funding alternatives and by no means make investments greater than you’ll be able to afford to lose.